All Categories

Featured

Table of Contents

- – Employee Benefits Broker Near Me Garden Grove, CA

- – Harmony SoCal Insurance Services

- – Best Payroll Services For Small Businesses Gar...

- – Payroll Service For Small Business Garden Grov...

- – Employee Benefits Center Garden Grove, CA

- – Employee Benefits Brokerage Firms Garden Grov...

- – Payroll Service Providers Garden Grove, CA

- – Key Man Disability Insurance Garden Grove, CA

- – Church Payroll Services Garden Grove, CA

- – Church Payroll Services Garden Grove, CA

- – Top Employee Benefits Brokers Garden Grove, CA

- – Payroll Service Providers Garden Grove, CA

- – Payroll Services Near Me Garden Grove, CA

- – Key Man Insurance Quote Garden Grove, CA

- – Harmony SoCal Insurance Services

Employee Benefits Broker Near Me Garden Grove, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

A Qualified Customer must be processing payroll with Paychex in order to receive 6 months of free payroll services, and any unused month is not redeemable in U.S. money or for any type of other entity. The Promotion just puts on pay-roll solutions, and Qualified Clients will certainly be entirely responsible for all charges due for solutions various other than pay-roll solutions.

We offer straight deposit and mobile payroll remedies that incorporate with time and attendance tracking. We additionally immediately compute deductions for tax obligations and retired life contributions, and provide experienced support to assist ensure you stay compliant with all appropriate guidelines and guidelines. ADP assists business manage payroll taxes by automating deductions from staff member incomes and making sure the appropriate quantity of cash is supplied to the government, based upon the latest payroll tax policies and laws.

ADP mobile services provide workers access to their pay-roll information and benefits, no issue where they are. Staff members can complete a variety of tasks, such as sight their pay stubs, manage their time and participation, and enter time-off requests.

Best Payroll Services For Small Businesses Garden Grove, CA

This process can be time consuming and error prone without the correct resources. That's why several employers turn to pay-roll company for automated options and conformity expertise. Companies usually aren't called for to withhold taxes from payments to independent professionals, which streamlines payroll processing. A payroll solution may still be of help.

Processing pay-roll in multiple states needs monitoring, understanding and conforming with the tax obligation legislations and laws in all states where you have employees. If you're doing pay-roll manually currently and plan to switch over to a pay-roll solution company, you must expect to decrease the time you commit to the procedure.

Payroll Service For Small Business Garden Grove, CA

ADP supplies payroll services for organizations of all dimensions small, midsized and big. We likewise accommodate many markets, including building, manufacturing, retail, medical care and more. ADP's pay-roll solutions are automated, making it easy for you to run payroll. Here are several of the key actions to the procedure that we'll deal with for you behind the scenes: The overall hours functioned by staff members is increased by their pay rates.

Privacy Preference CenterWhen you check out internet sites, they might store or get data in your browser. This storage is often required for the basic functionality of the website. The storage might be made use of for marketing, analytics, and customization of the site, such as saving your preferences. Privacy is essential to us, so you have the alternative of disabling certain types of storage that may not be necessary for the standard performance of the internet site.

These items are utilized to provide advertising that is more pertinent to you and your interests. They may also be utilized to restrict the number of times you see an ad and determine the performance of ad campaign. Marketing networks normally position them with the web site operator's authorization. These items permit the website to keep in mind selections you make (such as your individual name, language, or the region you remain in) and give boosted, extra personal features.

These items help the site driver recognize exactly how its site does, just how site visitors interact with the website, and whether there may be technical issues. This storage type generally doesn't accumulate details that recognizes a site visitor.

Employee Benefits Center Garden Grove, CA

Previous employees likewise have a choice for an on-line W-2 for 2024. The Pay-roll Provider Division is devoted to offering accurate and prompt solutions to workers and other stakeholders.

We have a commitment to accept change that advertises boosted efficiency, and we strive to go beyond the assumptions of our clients.

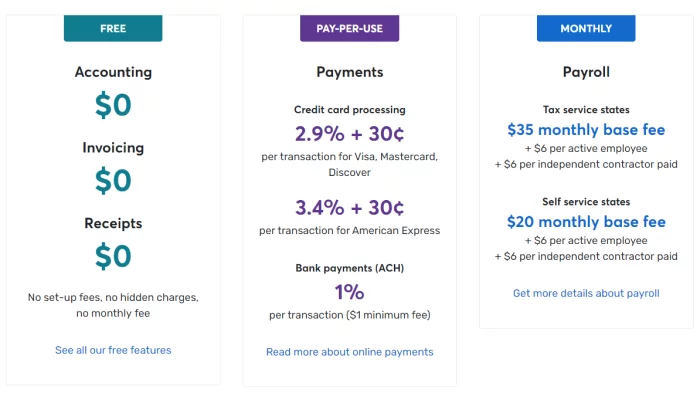

Swing pay-roll with tax declaring sets you back $40 plus $6 per active employee or independent professional monthly. This variation costs $20 plus $6 per energetic worker or independent service provider monthly.

Employee Benefits Brokerage Firms Garden Grove, CA

It immediately computes, documents, and pays pay-roll taxes. Companies can execute pay-roll jobs with voice aide combinations with Siri and Google or obtain message alerts.

Nonetheless, its full-service pay-roll software program quickly takes care of payroll for 25 and sets you back $29 monthly plus $7 per employee. The payroll company also offers self-service and family payroll solutions. The most effective tiny business payroll solutions supply budget-friendly strategies with core functions. Consider your present obstacles and future requirements when selecting pay-roll software application for your service.

Full-service pay-roll business file tax obligations on your part. Pay-roll rates may bundle tax filing, year-end forms, and staff member payments into the base cost.

Running pay-roll is one of the most crucial and time-consuming obligations for tiny organization proprietors. Contracting out payroll jobs can relieve these concerns.

Payroll Service Providers Garden Grove, CA

They function as an extension of your personnels (HUMAN RESOURCES) division and provide a variety of payroll solutions, from fundamental to progressed. Listed below, we'll go over the following: Obstacles of internal pay-roll processing management. Kinds of payroll jobs you deal with that can be outsourced. Advantages of using a payroll service. Questions to consider before contracting out pay-roll.

Comprehending exactly how providers handle pay-roll compliance. Questions to ask a payroll service provider prior to picking services. Little businesses encounter a number of obstacles when calculating and processing employee pay-roll and managing taxes.

The U.S. Bureau of Labor Data lists the typical pay for an accountant as $79,880 per year, not including advantages. And also, you might still make use of human resources software program to procedure pay-roll. The IRS assessed over $65.5 billion in civil charges in the 2023 monetary year. More than $8.5 billion in penalties were imposed on business for employment tax troubles.

There are several steps entailed in the small company payroll process, and pay-roll solutions for local business can take control of some or every one of these tasks. Employers determine the worker's gross pay, keep or garnish incomes as required, and send out incomes. You might likewise require to adhere to federal and state regulations, such as the Family Members and Medical Leave Act (FMLA), depending on the size of your business.

Key Man Disability Insurance Garden Grove, CA

You deal with some or all processes internally making use of pay-roll apps. These applications consist of do it yourself and full-service services for running pay-roll and tax obligation declaring. A full-time accountant or accountant Can help with payroll. They compute employee pay and pay-roll tax obligations and preserve records. Also, PEOs manage pay-roll processing. However they represent company of record and set you back greater than payroll software program and solutions.

Some provide qualified payroll reporting if you function on federal government contracts. The very best payroll providers update their software application often to reflect employment law adjustments, including guidelines for paid leave, overtime, and benefits qualification. Many have built-in conformity surveillance devices and informs for tax due dates and labor regulation changes. Seek pay-roll company that use tax obligation declaring guarantees and devoted assistance representatives or pay-roll tax obligation compliance specialists.

Church Payroll Services Garden Grove, CA

See if the software application offers multistate pay-roll monitoring or global services. When you consult with payroll suppliers for an on the internet trial or follow-up conference, have a listing of questions all set. Look into the supplier's newest updates and present pay-roll patterns to see if you have any new concerns. Below are inquiries to help you analyze capability, assimilation, and compliance in a tiny business payroll supplier: See if the service provider has an accuracy warranty, if it covers fines or charges, and just how promptly they settle errors.

From experience, I would certainly state that Harpers is at the top when it comes to pay-roll processing and tax obligation filing. Business Pay-roll Manager - 8/16 "I require to tell you that your Tax Division has actually been exceptionally practical and aggressive for me.

ANY PERSON I talk to in Client Service is able to jump in and address my inquiry. From the receptionist, to the customer solution people, IT team, Tax obligation group, and especially our Customer Solution Associate, I constantly obtain what I need.

Your solution to me is just the most effective. I always understand I can rely on you and for that I claim thank you." Independent school.

Church Payroll Services Garden Grove, CA

In this way, you don't have to check every cent going out the door. We'll also notify you of any check left uncashed after 180 days.

Be rest assured knowing all your Federal, State and Neighborhood pay-roll tax obligations will certainly be paid on time and compliantly. Likewise, your quarterly payroll income tax return will be filed in a timely manner and compliantly as well as your year end pay-roll tax settlements. Enjoy satisfaction understanding your tax obligation obligations are fulfilled.

On initial use, you'll create an individual account. If you don't have it, contact your Firm's Pay-roll Rep prior to trying to develop an account.

The price of small company payroll relies on numerous aspects, including payroll frequency, total variety of employees and the particular solutions that are needed. Many commonly, there is a per-payroll processing cost and an annual base cost. The important thing to bear in mind is that a pay-roll service may in fact save you cash when contrasted to the cost of tax obligation fines.

Top Employee Benefits Brokers Garden Grove, CA

Whether your organization is based on the East Coast, West Coastline, Midwest or one of the noncontiguous states, we have actually obtained you covered. You can be established on ADP's local business payroll in two simple actions: Offer us with your pay-roll records, including information concerning your business, your workers and their jobs, and state and local regulations.

ADP's tiny service payroll is automated, which means there's very little initiative needed on your part. Compute internet incomes and pay workers File tax obligation reports with government, state and local government agencies File and store payroll documents safely The frequency with which you can run pay-roll depends on your market and state guidelines.

We'll deal with you to produce a pay-roll calendar that suits your organization and conformity needs. Depending on your state's policies, your staff members might have the ability to access their pay statements electronically. Or, you may be required to supply them with printed pay statements. ADP's tiny service payroll sustains both versions.

The year is 2025, and the buzzwords in the office are health, balance, interaction, and, of training course, ...

While doing this, she worked in functioned other several such markets real estateActual property managementResidential or commercial property architecture, and marketing, advertising and marketing othersAmongst Her areas of details know-how are leave administration, procedure, conformity, policy and management, client interaction, worker connections, pay-roll, and recruiting.

She continuously informs herself on conformity and remains up to day on brand-new plans and regulations country wide and at the state, area, and regional levels.

Payroll Service Providers Garden Grove, CA

Small company payroll usually results in a large headache as managers and proprietors discover exactly how to do pay-roll manually., your pay-roll computations are automated.

Today's manager have much more on their plate than everand discovering the finest payroll business should not be one of them. We stay in an intricate world of 'Big Information.' While the devices to assist accomplish work are as advanced as they have actually ever been, the ordinary employee today still commonly reports sensation worn, assisting to drive the record resignations of the last several years.

Also if you already have the finest group in location, without the right devices, job will be duplicated, initiative lost and frustrations placed. That's why choosing the most effective payroll firm for you and your workers is extremely important to running your company like a well-oiled device. Below's a checklist of the leading 20 Payroll Firms running today and what you require to understand about them: No matter what company you select, the finest payroll company for your organization's requirements relies on its particular objectives, consumers, clients and employees.

Payroll Services Near Me Garden Grove, CA

1IMPORTANT INFORMATION FOR OPENING A CARD ACCOUNT: To assist the federal government deal with the funding of terrorism and money laundering activities, the U.S.A. PATRIOT Act needs us to acquire, verify, and record information that determines each person that opens a Card Account. WHAT THIS IMPLIES FOR YOU: When you open up a Card Account, we will certainly request your name, address, date of birth, and your federal government ID number.

Card activation and identification verification needed before you can utilize the Card Account. If your identity is partly verified, full usage of the Card Account will certainly be restricted, yet you may be able to use the Card for in-store purchase transactions and atm machine withdrawals. Constraints consist of: no global purchases, account-to-account transfers and extra tons.

Key Man Insurance Quote Garden Grove, CA

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

Use of the Card Account is subject to activation, ID confirmation and funds accessibility. Transaction costs, terms, and conditions apply to the use and reloading of the Card Account.

Employee Benefits Consulting Garden Grove, CAKey Man Insurance Vs Life Insurance Garden Grove, CA

Church Payroll Services Garden Grove, CA

Local Seo Citations Garden Grove, CA

Near You Seo Services Near Me Garden Grove, CA

Harmony SoCal Insurance Services

Table of Contents

- – Employee Benefits Broker Near Me Garden Grove, CA

- – Harmony SoCal Insurance Services

- – Best Payroll Services For Small Businesses Gar...

- – Payroll Service For Small Business Garden Grov...

- – Employee Benefits Center Garden Grove, CA

- – Employee Benefits Brokerage Firms Garden Grov...

- – Payroll Service Providers Garden Grove, CA

- – Key Man Disability Insurance Garden Grove, CA

- – Church Payroll Services Garden Grove, CA

- – Church Payroll Services Garden Grove, CA

- – Top Employee Benefits Brokers Garden Grove, CA

- – Payroll Service Providers Garden Grove, CA

- – Payroll Services Near Me Garden Grove, CA

- – Key Man Insurance Quote Garden Grove, CA

- – Harmony SoCal Insurance Services

Latest Posts

On Demand Water Heater Miramar

Plumbing Emergency Near Me Solana Beach

Torrey Hills Sewer And Drain Cleaning

More

Latest Posts

On Demand Water Heater Miramar

Plumbing Emergency Near Me Solana Beach

Torrey Hills Sewer And Drain Cleaning